Introduction to Banking Systems

Various banking icons (rambo182, iStockphoto)

Various banking icons (rambo182, iStockphoto)

How does this align with my curriculum?

Learn about money and how traditional banking systems work.

What is money?

We use money just about every day. We buy things using money. We get paid money to do work. But have you ever thought about what money is? Probably not!

Money Serves 3 Important Functions

1. Money is a unit of measurement

Money allows people to quantify the cost of goods and services in a standard way. It allows buyers and sellers to understand and compare the value of goods and services.

2. Money is a form of exchange

In the early days, people exchanged one good or service for another. We call this bartering. Bartering relies on people wanting to trade with each other. For example, I want to trade my chicken for your shiny stone. Over time, money took the place of actual objects. For example, I will sell you my chicken for five dollars.

3. Money is a generally accepted form of payment

A long time ago, the actual value of money came from the material it was made of. Coins were often made of gold and silver. Today, the coins we use are no longer made of precious metals.

Goods and services are traded between countries as well. You might have heard of exchange rates while travelling. An exchange rate is the price of a country’s money in relation to another country’s money. For example, one Canadian dollar does not have the same value as one dollar in another country. This rate changes all the time.

Money Has Certain Characteristics

All money, no matter what form it takes, has certain characteristics.

- Money is durable.

This means that it is able to last for a long time. Coins and dollar bills are designed to be durable. Apples and chickens are not! - Money is portable

This means that it is easy to carry around. It is far easier to carry around dollar bills or credit cards than rocks or chickens. - Money can be divided

Many transactions are not for round numbers of dollars. This is why money should be able to be divided into smaller units, such as dollars into cents. - Money is uniform

All money used by a given group of people must be the same no matter where or how the money is used. - Money is not limitless

As the saying goes, “money does not grow on trees.” If money was endless, it would no longer have value. Most money is produced by a government that controls its supply. - Money is accepted

People must feel confident that their money has value. Governments demonstrate this by having people use money to pay their taxes.

Did you know?

Canadian money is waterproof! There are even rumors that the $100 Canadian bills smell like maple syrup!

Paper Money

Various Euro coins and cowrie shells (Source: mgfoto via iStockphoto).

Image - Text Version

Shown is a colour photograph of copper, gold and silver coloured metal coins in various sizes, and three small, white bean-shaped shells.

The camera is close to the money, looking down from above. The larger coins are silver in the centre, with a wide border of pale gold. These are embossed with a large number one and the word "Euro." The smaller coins are copper coloured, embossed with theatrical masks or a globe on a striped background, the number one and the word "Cent." The shells are shiny, pale cream coloured, and oval shaped. Each one has a long, narrow, dark opening down the centre, with scalloped edges. The surface below appears to be white bank notes printed with pale brown images.

Although coins had some advantages, they were still pretty heavy to carry around and needed to be stored safely. A solution to this was to make money using paper.

Early Chinese banknote (Source: Ancient Chinese Cash Notes - The World's First Paper Money - Part 1 [public domain] via Wikimedia Commons).

Image - Text Version

Shown is a colour photograph of a rectangular piece of paper printed with text and images.

The paper is pale gold with uneven edges. It is printed with black line drawings in three panels, stacked vertically. The top panel contains what looks like ten round coins. The centre panel contains seven vertical lines of Chinese characters. The bottom panel contains a drawing of three people in a courtyard, surrounded by buildings with pagoda-style roofs.

Traditional Banking Systems

With all of these coins and paper notes floating around, people realized that they needed a safe way to store their money, while still being able to access it when they wanted. This led to the invention of banks.

There are two kinds of banks; commercial banks and central banks. Commercial banks are run by people as a business. They make money by charging a fee to use them. You’ve probably visited a Bank of Montreal, CIBC or ScotiaBank. Central banks are run by the government, such as the Central Bank of Canada. One of the roles of a central bank is to oversee the commercial banks and make sure they are operating properly and honestly.

Did you know?

The oldest surviving bank in the world opened in 1472 in Italy. It is called Banca Monte dei Paschi di Siena.

Banks use what we call double entry bookkeeping. The coming and going of money, called transactions, were originally written down in books called ledgers. Ledgers showed transactions of money to and from the bank. A ledger from a bank account could look something like this:

John’s Bank Account

| Date | Details | Debit (Money going out) |

Credit (Money going in) |

Balance (What is in the account) |

|---|---|---|---|---|

| Jan. 1, 2023 | $300.00 | |||

| Jan. 3, 2023 | Cheque from grandma | $100.00 | $400.00 | |

| Jan. 5, 2023 | Bought shoes | $90.00 | $310.00 |

With the invention of banks, some of the features of paper-based money were lost. For example, before people used banks, they were responsible for their own money. This would be like you keeping a shoebox full of cash under your bed. If anything happened to the money, only you would be responsible. Banks, on the other hand, are controlled by a small group of people who keep the ledgers. These people are professionals tasked with keeping your money safe.

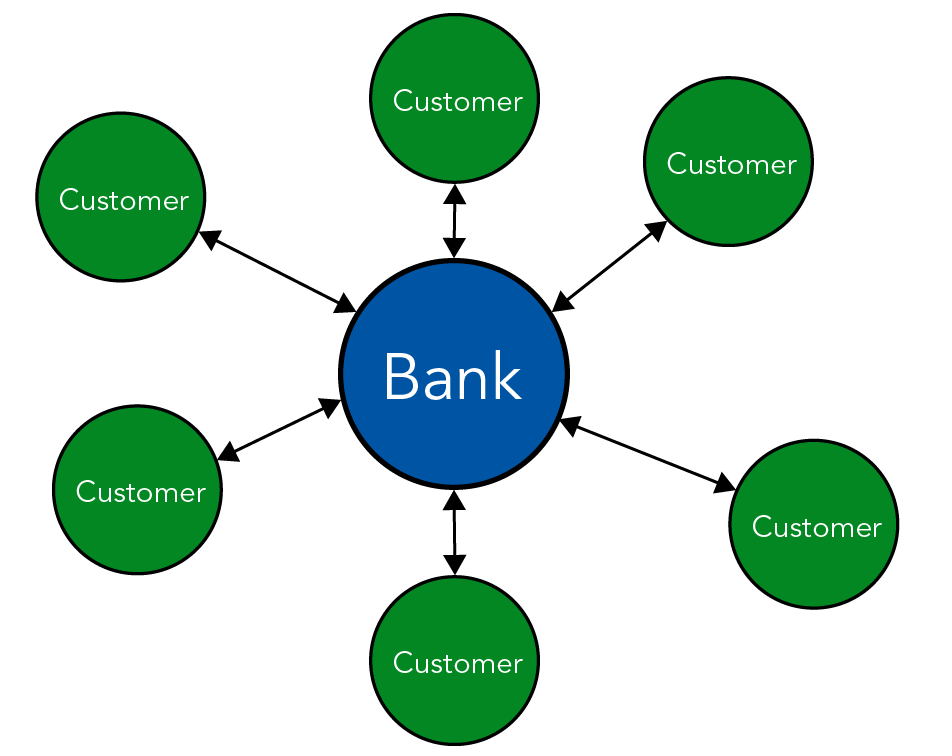

Centralized bank (©2023 Let’s Talk Science).

Image - Text Version

Shown is a colour diagram illustrating a bank's relationships with its customers.

A large blue circle in the centre of the image is labelled, "Bank." Around this, six smaller green circles are labelled, "Customer." Each customer is connected by a double-ended, black arrow to the bank.

In order for a bank to work properly, the bank needs to:

- Keep accurate records of transactions

- Be trustworthy

- Store records safely

- Be available for people to access their money

You might already be thinking to yourself that the centralized approach has some downsides. It relies upon trustworthy people, who don’t make mistakes and are always available. That is a lot to ask!

Centralized Digital Money

Back in the day, it was pretty easy to buy and sell goods in your own community. But what if you wanted to send money to a person farther away? Putting dollar bills into the mail is one option, but what if it gets stolen along the way? People could also set up a chequing account at their bank. This way they could send a piece of paper to the person they were buying from. This paper was called a cheque. That person would deposit the cheque into their account. In effect, it was transferring money from one person’s account to another's. This process worked, but it was pretty slow! For this reason, electronic money transfers were invented (sometimes called e-transfers).

Old telegraph line on the Thompson River in British Columbia (Source: Andrew Bowden [CC BY-SA 2.0] via Flickr.com).

Image - Text Version

Shown is a colour photograph of a wooden pole connected to many wires, next to a river.

In the foreground, the pole is dark wood with four horizontal arms. One arm is broken so that it hangs diagonally across the others. Multiple wires are connected to small spools on these arms. The wires stretch off from the pole to the right edge of the image. They hang loosely down the left side.

In the background, a greenish blue river looks deep and fast, surrounded by low beige hills. The pole is installed very close to the edge of the water.

Moving money electronically took off as the Internet grew. People could use computer networks to send and receive money from their banks. This is the way that most people access their money today. Banks also work with other services, such as credit card companies, to let you borrow money for a short period. If you do not pay it back in the alloted time, they charge you interest on any amounts that are outstanding. The growth of the internet gave rise to digital banking.

Now, instead of going through a bank, you can also use an online payment service, such as PayPal or Stripe. These companies let you do online money transfers directly to other people. These services still require you to have a bank account or credit card set up. They also charge a fee for this service.

Top: Logo for Apple Pay; Bottom: Logo for Samsung Pay (Sources: developer.apple.com and Logo-download.com).

Image - Text Version

Shown is a colour illustration of two logos on a white background.

The top logo is a rectangle with rounded corners. Inside is a black silhouette of an apple with a bite out of it, and the word "Pay" in large black font.

The bottom logo starts with a blue, rounded square shape with the word "Pay" in large white letters, on the left. Then, the word "Samsung" in tall, narrow capital letters with no crossbars on the As. Finally, the word "pay" in larger, wider, lowercase letters.

What traditional banking, using credit cards, digital payment services and digital wallets all have in common is that they require permission to use and involve a centralized ledger.

It was the downsides of centralized systems and the rise of the Internet that led some people to think there could be a different way to think about digital money or cryptocurrency.

Learn More

The History of Paper Money - Origins of Exchange (2016)

This animated video from ExtraCredits explains how humans went from exchanging goods to exchanging printed paper for goods and services.

Banking Explained - Money and Credit (2015)

This animated video from Kurzgesagt – In a Nutshell shed a bit of light onto the banking system. Why were banks invented, why did they cause the last crisis and are there alternatives?

References

Encyclopedia Britannica (n.d.). Exchange Rate.

Frankenfield, J. (Jul 22, 2022). Currency: What It Is, How It Works, and How It Relates to Money. Investopedia.

Kusimba, C. (Jun 19, 2017). When - and why - did people first start using money? The Conversation.

Türkiye Cumhuriyet Merkez Bankası (2019). History of Money [Video]. YouTube.